Companies often pose this question, implying that there is a magic answer or all-encompassing industry benchmark that can accurately evaluate whether their salespeople should cover more, fewer, or the same number of accounts. The studies that do exist can provide…

Our Blog

Read Our Latest Articles, Tips & News

In our line of work, we get to spend a lot of time with salespeople. We hear the good, the not so good and even worse. One of the topics that always seems to fall in the more challenging column…

When a current sales year starts to wind down, it becomes time to consider sales compensation plan needs for the next fiscal year. Companies should have appropriate plan designs ready-to-go and set for communication within the first two weeks of…

Recently, several of our clients have been grappling with the issue of pay mix. Their questions and issues usually fall into three categories: “how do I determine what is the right pay mix for this sales role?”– (Mix Methodology), “my…

Quota Plans are Plentiful but Good Quota Setting Processes are Not Quota based plans are very prevalent today and with good reason. Quotas allow for customizable plans taking into account the unique qualities and potential of each territory. They promote…

Quota-setting. If that phrase causes a twinge of pain, you are not alone! Over our many years of working with sales organizations, quota-setting has been a topic that causes consistent concerns across both the sales force and those concerned with…

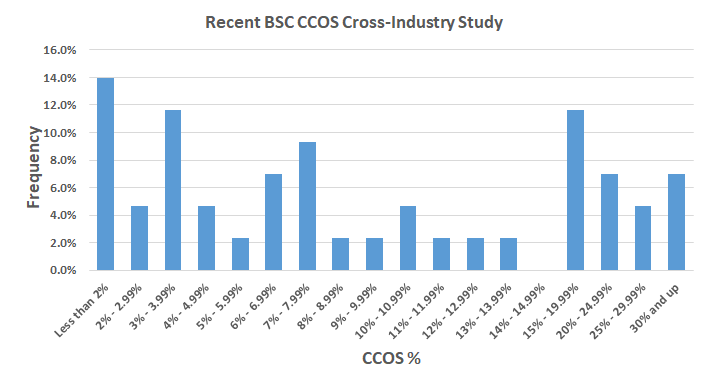

After almost 30 years of consulting with leading companies on sales effectiveness and sales compensation, I’ve come to the conclusion that other than calling every sales compensation plan “commissions”, the most misunderstood and mis-applied concept in sales compensation is CCOS,…

MBO + KSI + KSO = How to Turn IH8U into IHEARTU? Management by Objectives (MBOs), Key Sales Initiatives (KSIs), Key Sales Objectives (KSOs) – No matter what acronyms they are assigned, objectives based incentive pay programs or components within…

In a typical sales organization, sales reps can be categorized as A players (stars), B players (good/decent), and C players (poor). We often find a normal talent distribution with 20% in group A, 60% in the group B, and 20%…

The end of the calendar or fiscal year usually includes some familiar activities – finalizing contracts for future shipments and revenue streams, finishing performance and salary reviews, getting budgets in by the deadline, and putting out the latest fire (while…