A sub 5% unemployment rate. Studies from CNBC and others suggesting over 55% of employees are looking to change jobs. Linkedin recruiters wearing out keyboards punching out interview request after interview request. Expectations of a uniquely large and Great Resignation period. The picture has become more and more clear, and sales leaders and Human Resource departments universally feel threatened by these significant retention challenges. Many companies seem to be focusing on the defensive side of the war for talent – how can we retain our salespeople?

While that’s a understandable question, we’ve noted great success for those organizations who see this fluid labor market as a chance to move strongly from playing defense to playing offense. How can we become the threat to take away a competitor’s best and brightest? How do we move from trying to just maintain one’s balance, teetering on one’s heals, to pushing forward, with stable footing, and attracting the talent you need for growth today and tomorrow?

Our answer – improved sales compensation programs and designs.

Among a range of factors such as flexible work arrangements, improved work/life balance, more interesting work content, positive management practices, and other dimensions of a healthy Employee Value Proposition, we find sales compensation offers one of the best and quickest strategies to shift your organization’s mentality back to offense. This article features best practices companies are using to achieve successful talent management and drive overall sales results.

1. Retain your best salespeople.

Okay, okay… admittedly the best way to transition to playing offense starts by plugging up weaknesses in your defense. You can’t move the ball if you don’t have the ball. Put another way, adding great talent into your human capital bucket won’t achieve much if there are glaring holes in the bottom. Clearly, the first step is to plug any holes.

But not all holes are created equally. Step one is to identify the top salespeople that you need to retain. These may be the top quota achievers, top earners (perhaps), folks with critical customer relationships, or those who serve as role models for other high performers. Target these folks and then apply some of the upcoming concepts that we’ll discuss for acquiring top talent.

What about the rest? Be willing to take some losses. In many cases, losing low or even mid-tier talent can be an unheralded benefit. Let your competitors overpay or bend-over-backwards for them. Open up slots for some of your up-and-coming talent to develop into greater prominence or fill openings with better salespeople from the market. Many experts believe that healthy annual sales force turnover should range from 15-20%. Be willing to lose some personnel because you’ll have an effective sales compensation program and philosophy to help attract even better people.

2. Prepare to pay for top talent.

Even in typical times, one of the most confusing conversations goes something like this:

Company: “We want to attract the best talent out there!”.

BSC Response: “Great! So where do you target your pay levels versus the market data?”

Company: “We always target the median”.

BSC Response: Huh. [With confused puppy head turn.]

To attract top talent, you have to pay for top talent. Again, other elements of the EVP clearly make a difference, but the level of direct compensation is one of the most obvious reflections of an employee being valued and is easily comparable. Perhaps you don’t need all salespeople to be from the top quartile of talent, but for certain roles where you do or for specific individuals, reconsider your pay targeting. Having 75th percentile labor market talent likely requires paying at least at the 75th percentile of market pay. Seems hard to dispute that logic, yet it’s a common disconnect in company practices.

One approach of course is to target median, if required, but be willing to create a range, perhaps +/- 20% or wider. Some of the better talent would simply come in at the higher end. In some cases, companies create tiers, such as Account Executive I and Account Executive II, with different pay and productivity expectations.

One challenge in a fluid labor market like today though is determining this moment’s actual market pay levels. Unfortunately, market data is often a trailing indicator of where things really stand. Historically, this is often the case in hot international markets with fast pay escalation; think of a market like India and others. While we don’t necessarily expect quite that level of pay increases (time will tell), the reality is some of the pay benchmark surveys may be outdated almost as soon as they are documented.

Start with that assumption and either widen the top end of your pay range or assume something abnormal like an aging of 5%, 10% or even 15%. Overall, attempt to have the right pay benchmarks, be flexible in your pay ranges, and be realistic that you’ll only attract top talent with higher pay levels. Attracting the best and brightest will pay dividends and help realize greater ROI, as we’ll examine later in this article.

3. Welcome them aboard with supportive pay practices.

New hires, even the best ones, will often require a period of time to get comfortable, ramp up, and really hit full stride. Your pay practices should provide support and relief during that process. We ask companies for estimates about the time required from new hire to full production, and many will cite 6 to 12 months, if not longer. It’ll surely depend on the person, but you can and should create healthy pay practices to support this transition period.

- Draw programs – ideally non-recoverable for an initial phase, sometimes followed by a recoverable one. Such draws of course can take many forms and need careful consideration.

- Guarantees – similar to draws but often intended to be something slightly different. These dollars can represent additional guaranteed earnings while incentives can still be earned independent of a formal draw design, and guarantees often occur over multiple pay periods. Again, we frequently see companies defining these concepts differently, so it’s important to consider the intention. These differences are often found in the mechanics and the subtle nuances in messaging to the salesperson.

- Signing bonuses or retention bonuses – similar to the notion of a guarantee, these are often needed today at point-of-hire while guarantees sometimes stretch out more over time. Meanwhile, retention bonuses are paid or earned in the future with some expectation of staying in the organization. Retention bonuses can be used of course with current high performers or new hires.

Some thoughtful policies can go a long way when welcoming the best talent and giving them the time to shine. And then it’s all about enabling ongoing success and ensuring optimal earnings, as we’ll next discuss.

4. Ensure you utilize a high performing sales compensation plan design.

That leads us to some of the more impactful elements and the ones that drive ongoing success. Use these labor market challenges and opportunities to assess the overall state of your sales compensation plan design and create optimal changes to ensure you’re well-positioned. Attract the best sales talent and you’ll achieve the best sales results. The most successful pay programs focus on these elements:

- Use goal-based plan designs. Across industries and company phases, plans that feature a Target Incentive amount with a reasonable quota consistently prove to be better drivers of growth and can more fairly pay across diverse sales roles and populations. Meanwhile, absolute commission plans often create inequities simply based on unequal assigned account or territory opportunity and then will fail to drive growth when top earners become stagnant and take one’s foot off the gas. There is much more to say on this topic, but we’ll simply suggest to use well-designed goal-based plan designs.

- Use simple plan designs. This is an obvious one related to best practices; don’t over-engineer or complicate your plan designs! No more than three measures (and even one or two if possible). Use simple pay lines with reasonable downside and exciting upside. In most cases, focus on an annual goal period but with more frequent payouts (monthly or quarterly). Avoid caps and other elements that create more noise or complexity than real value.

- Carefully consider pay mix by role and manage to them. A new business salesperson should likely be in the 50/50 to 60/40 pay mix range. An account manager is often closer to 70/30. Managers skew to a less aggressive pay mix than direct reports since they are usually removed a level up from most deal details and thus less prominent. There are exceptions to these guidelines which is where careful consideration is required. But in a well-designed goal-based program, upside opportunity is spoken in multiples of Target Incentive, with top achievers being able to double or triple Target Incentive. Nailing the right pay mix is essential both to create downside, but more importantly, to create upside energy. With the right pay mix established, you should then manage to it. By that, we mean to keep it consistent. For example, when applying merit increases, don’t just adjust base but be sure to adjust the Target Total Compensation to keep the pay mix and sales energy as intended. For example, if proposing a $5K merit increase for a 60/40 pay mix role, apply $3K to base and $2K to Target Incentive. Voila, the 60/40 pay mix is maintained, and there is now more upside available for high performance.

- Include reasonable downside. Building on the prior concepts, ensure the right pay mix as well as the right pay lines. Down years in sales should feel bad and pay poorly, within reason. Here though, the primary watch-out is not to overemphasize the threshold in a pay line, whether using a soft threshold that pays from dollar one but at lower than 1x or a hard threshold that only begins paying once the salesperson hits a minimum level of quota attainment. Thresholds hopefully don’t knock more than 5-10% of a sales population out of any variable incentive earnings. Truly low performers won’t be daunted by missing anyway, and you’d be better off managing them out or maybe letting an unbeknownst competitor poach them in today’s competitive labor market.

- Feature exciting upside. Again, building on the prior concepts, upside is perhaps the most important element of a sales incentive program looking to attract and retain top talent. Don’t be stingy here and do be sure to use Compensation Cost of Sales (CCOS) as the proper measure of your sales incentive spend. Well-designed pay lines with aggressive yet sensible accelerators are often quite affordable when realizing that base pay is spread out over those total results a well. We have more detailed articles available on CCOS and often preach its value for use as the primary and most important sales incentive cost metric. We’ll also examine this a bit more in the final section.

- Don’t forget about Rewards and Recognition. R&R programs usually do not require a great deal of spend, and we often find creative programs can garner disproportionately high attention and positive outcomes versus just cash incentives alone. Top salespeople, particularly in some generations, seem to highly value being recognized, whether individually or as part of a winning team. Use your R&R program to differentiate your organization and provide a little extra juice to your incentive program.

5. Expect your top salespeople to produce like top salespeople.

This is really the punchline or purpose to the entire topic of attracting and retaining top salespeople – these folks should become your best and highest producing sellers. That reality is the primary pitch one should make to finance or company leaders when expressing the need to pay top dollar for top talent, to offer added incentives to join or stay, and for having exciting and noteworthy upside in your incentive plan designs.

How does this manifest itself? One key design element is that goal-based plans allow a company ideally to set higher targets for these higher paid and hopefully better performers. Goals should be fair of course (sometimes easier said than done), but if these salespeople are worth earning higher pay levels then one can fairly expect greater results. Perhaps an AE I has one pay level and quota range while the higher paid AE II has a higher higher quota expectation. That’s one structural approach to such a model.

Won’t these higher paid people cost us more? Well, yes and no. In simple terms, they will indeed cost more. Higher Target Total Compensation > Lower Target Total Compensation. But that’s just the 30,000-foot level. As mentioned earlier, Compensation Cost of Sales is really the metric one should be evaluating; we need to look at total compensation payouts (base plus actual variable) divided by total revenue (or whatever volume sales metric you prefer).

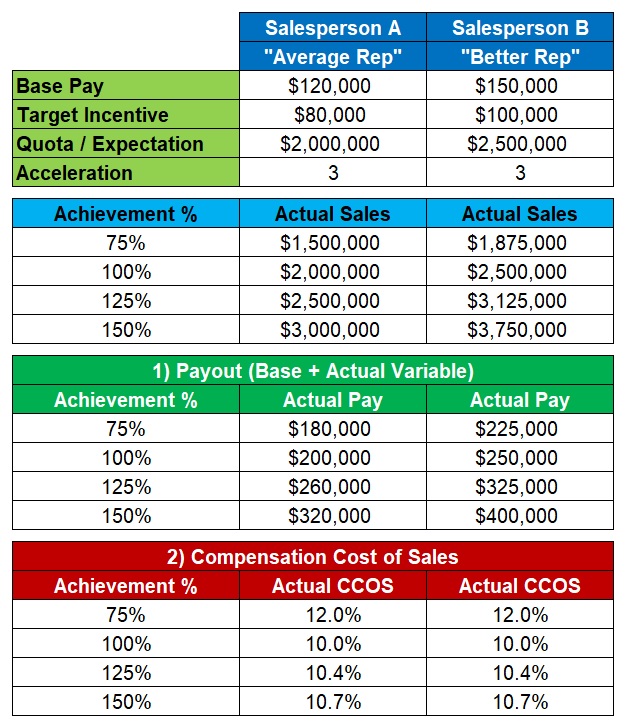

The premium you are paying in TTC should be related to the premium results one can expect. In this simple illustration, we demonstrate how a 25% premium on TTC with a matching 25% higher productivity expectation logically yields identical CCOS levels. But the company of course will realize topline sales results and higher total profit from the results generated by the “Better Rep”. Let’s observe a simple example:

The Average Rep has a TTC of $200K and the Better Rep’s TTC is $250K. The Average Rep is expected to deliver $2M in sales while the Better Rep should deliver $2.5M. In both cases, we use the same simple plan design and pay line, with no threshold and a 3x accelerator. Section 1 shows the actual payouts, which are indeed higher for the Better Rep. But they are paid against higher total sales, and as a result, this example shows identical CCOS percentages in Section 2. At target, both individuals have a CCOS of 10%. CCOS is higher below goal (as the fixed base is paid against lower sales) and CCOS is higher above goal because the accelerators kick in and we pay a bit more for growth. The simple takeaway is that higher pay with higher expected results is still a win-win for the organization and the salesperson as well. Application can vary, but it’s easy to consider approaches that create higher returns and better outcomes from paying for better and more productive sales talent.

Conclusion – Carpe Diem!

The concepts presented here are ones we’ve been witnessing in organizations that are successfully turning today’s retention fears into a moment of strength and opportunity. In the investment community, we all know wise investors make money while everyone else is panicking and selling. Similarly, while others are panicking to retain whoever they can, the winners will be going on the offensive. With the right foresight, the Great Resignation can represent an excellent opportunity to step up your sales incentive game, secure new and improved sales talent, and set the stage for superior sales results for today and tomorrow.