One of the most common questions we receive from software organizations today is how the sales compensation program can support the strategic evolution from traditional licenses to subscription-based (SaaS) models. Wall Street and company valuation methodologies all seem to reward for it, and many have to come to label this the new “strategy du jour”. It’s not always the easiest change to make and the change itself may mean different things and have different implications to those espousing such a strategy. While each organization’s specific needs, opportunities, and intentions may be unique, there are a number of considerations that we recommend keeping in mind.

Subscription Sales – “New to Some but Not to Others”

It’s helpful to first realize that subscription or recurring revenue transactions may be somewhat new to software companies but they are not new to a wide range of industries. Consider insurance premiums that renew each year and thus represent run rate business. Or consider an organization that sells credit information to banks for loan processing; they buy that information each and every year. From the Consumer Packaged Goods space, channel managers who sell through retail chains clearly experience run rate revenue. For those who want to go way back and may have hoofed it as a newspaper delivery person, that too is a run rate or recurring revenue model. I recall getting my $1/month for each house on my route; I didn’t know I was on the cutting edge of strategic evolution. The key distinction is a company serving as an ongoing supplier of products or services versus a company with one-time or intermittent purchases. Clearly, many industries have been wrestling with this topic for a long time, while some software organizations are facing it for the first time, at least for software licenses although not necessarily for maintenance and/or services.

In some of these industries, such as insurance, compensation is paid on the run rate business, which creates a familiar annuity stream that is often common and accepted. In some worlds, these plans will utilize a hard threshold (compensation payouts occur only after a certain point of results) or a soft threshold (compensation payouts start at first dollar but at a lower rate and increase as results progress toward a performance expectation or goal); these pay line features can help focus sales energy on the portion of the achievement curve most under a rep’s control, e.g., where they control protection and growth, rather than purely absolute volume. These are not necessarily models that the software industry typically tries to emulate nor should, but it’s a good reality check to understand that the situation is not truly new.

Software and the Focus on Bookings

Software is one industry with a legacy of paying on bookings. Compared to some pure revenue based models, paying on bookings or contract signing more closely ties the compensation payouts to the software license sales directly under a salesperson’s control. Folks often feel booking-based plans create more sales energy, inspire more motivated reps, and align to exciting sales cultures. And bookings of course avoids the annuity feel in high run rate models and avoids the challenges of using thresholds to create the right energy. [One side note of course concerns the need for role clarity and who supports new vs. existing accounts, but that’s broader than this article and is best left for another day.] In terms of sales comp practices, we find software organizations are most interested in continuing to pay sales incentives on some form of booking, and so most designs attempt to align to this objective. But how and where do subscription licenses fit?

Software Evolution Part I – “Living in Both Worlds”

In many cases, when software companies talk about evolving from traditional licenses to subscription licenses, they rarely mean a sudden and wholesale change from selling perpetual licenses to term and/or SaaS. Particularly in large software transactions in a B2B space, we find most companies really mean they want to support a customer buying the software in any number of ways – perpetual, term, or SaaS. The organization wants to support any and all software license sales, while still encouraging a steady and gradual migration toward subscription deals. Even then though, many acknowledge that customers need to be allowed to buy the way they want to buy, or some competitor will swoop in and offer the flexibility the customer desires. In these cases, the most important feature of a sales compensation plan is that it does not push a salesperson to force a customer to buy in an uncomfortable way.

One important concept companies consider is how to create deal neutrality or deal agnosticism for the sales rep. This means that no matter how the customer wants to buy, the sales credit and the incentive payment is kept relatively consistent. If we pay the same effective commission rates for a perpetual deal vs. an annual license, it’s easy to see the rep will only push for the much larger perpetual deal. Poorly designed sales comp plans can sabotage rather than enable an evolving subscription strategy.

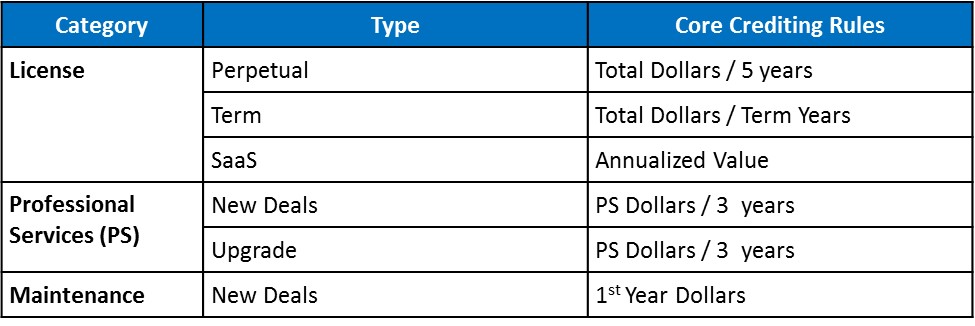

One of the most common approaches is to find way to normalize the credit of each license. One technique is to decrease the sales credit for a perpetual deal to align to the Annual Contract Value (ACV) for comparable subscription deals. We also of course need to consider how to handle Maintenance as well as Professional Services, all under the construct of paying on bookings. In the space below, we provide an example of how one organization chose to create deal neutrality.

This table was specific to one organization’s business and will almost surely not be perfectly applicable to another. But the overall concepts are worth consideration. This client determined their Core Crediting Rules based on a historical analysis of prior deals and an estimate of how they could create deal neutrality for future deals. The salesperson was basically kept whole in terms of sales crediting and compensation, regardless of how the customer wanted to buy.

In other cases, we’ve seen examples of crediting rules that slightly overvalue the results for SaaS versus traditional licenses. Or we’ve seen crediting upticks on the ACV value based on the number of binding years in the contract. Again, each case is different, but the overall concept is one of the better sales compensation practices companies should consider when moving from traditional licenses to subscription based opportunities.

Software Evolution Part II – “Diving in with Both Feet”

In much less common cases, a company may simply decide to actively end sales of traditional licenses and move 100% to subscription based sales. The case of Adobe several years ago is one commonly cited example where an organization made an aggressive and near full scale move. In these cases, the necessary sales compensation plan design approach still goes back to best practices – identify the right measures, determine the best mechanics, and work on the plan details to accomplish your objectives. In many ways, companies that go in with both feet are resurrecting as pure play SaaS organizations, and terms like MRR, QRR, and ARR will all arise. In reality, the building blocks of an ACV based plan, potentially with crediting upticks for multi-year results can still work quite effectively. ACV and SaaS sales often go hand-in-hand.

Overall Impacts – “Be Careful What You Wish For”

In most cases we’ve encountered, strong early enthusiasm to move toward subscription based deals ends up waning a bit as repercussions are assessed. There are usually significant revenue recognition impacts in the current year. Companies like Adobe had to prime the market to understand that near term revenue may drop to gain the benefit of steadier and longer-term results. We’ve seen this effect even in privately held companies as no one wants to miss overall financial targets or see near term increases in the expense to revenue relationship, even when considering the future benefits that subscription-based results can offer. Patience is rarely a virtue in today’s modern world.

As one recent client told us, “We can’t kick our addiction to end-of-year perpetual deals!”. We hear this quite often. There are cases where a company’s leadership may simply need or want to have a deal taken perpetually versus sticking to the steady subscription strategy. In such cases, having a deal agnostic sales compensation plan can ensure the sales representative is willing to follow whatever directions he or she is given. The right plan can align overall strategic vision, pragmatic in-year revenue recognition requirements, and the resulting sales compensation payouts. It can also work for the customers who are allowed to purchase the way they desire. Ultimately, we believe the best sales compensation plans work for the company, the sales representative, and the customers as well.